Yesterday, we drank coffee and waited...

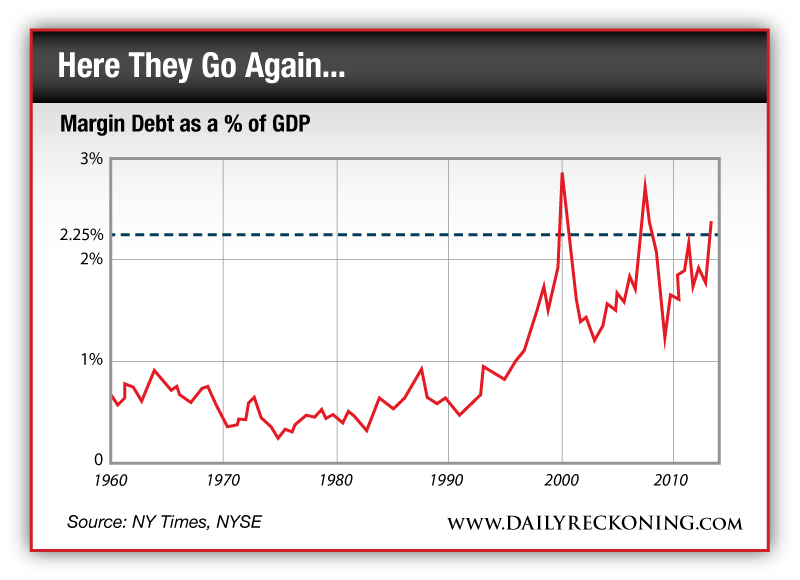

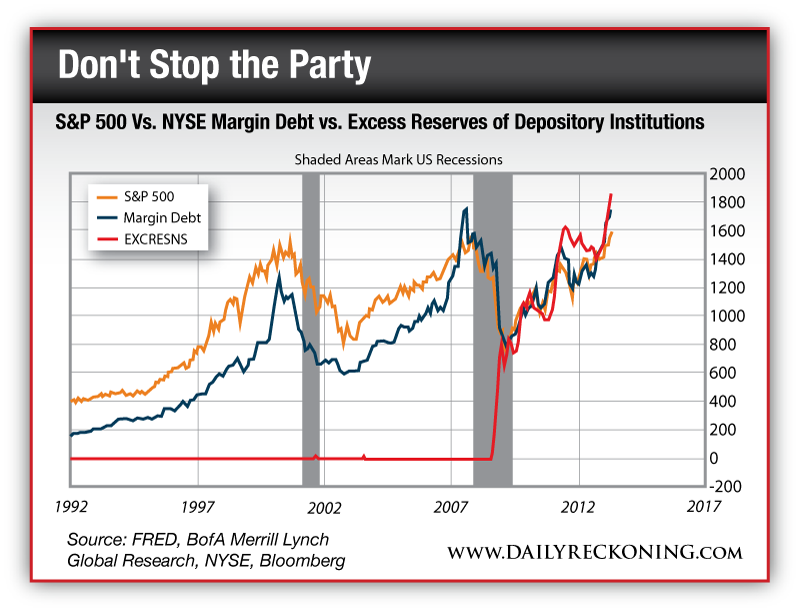

Yesterday, we drank coffee and waited...To pass the time, you'll recall, we muddled through an Edinburgh University study of former Fed chair Alan Greenspan's confidence level and whether it could be used to forecast movements in the gold price. Now we know the answer to a slightly different question. The lack of confidence others have in current Fed chair Ben Bernanke's statements can certainly move the gold price... and the price of everything else, too. Down. "Pick your poison," chimed in The Rude Awakening's Greg Guenthner this morning. "Bonds. Stocks. Emerging markets. Commodities. Wherever you decide to turn this morning, you'll see red on your screen." No kidding...  Crimson Shades of '08 Ouch. Where does all that money go? "Money heaven..." Dave Gonigam, our compatriot at The 5 Min. Forecast, suggests. What comes "out of thin air"... returns from whence it came. "American investors have taken out more margin loans than ever before," observes Floyd Norris in The New York Times. When the stock market hits consecutive highs, as it has for the past 6 months, individual investors pile in... and are willing to borrow money to speculate. "Speculative investing has grown among retail investors," Norris continues, "reaching levels that in the past indicated the market was getting to unsustainable levels and might be in for a fall." Floyd offers U.S. margin debt as a percentage of U.S. GDP as a guide:  "The first time in recent decades that total margin debt exceeded 2.25% of GDP came at the end of 1999, amid the technology stock bubble. Margin debt fell after that bubble burst, but began to rise again during the housing boom -- when anecdotal evidence said some investors were using their investments to secure loans that went for down payments on homes. "That boom in margin loans also ended badly." Will this time end badly? We don't know... but we're willing to hazard a guess. "The rising level of debt is seen as a measure of investor confidence," says Alexandra Scaggs in today's Wall Street Journal, "as investors are more willing to take out debt against investments when shares are rising and they have more value in their portfolios to borrow against. "The latest rise has been fueled by low interest rates and a 16% year-to-date stock market rally."  Summary: The Fed pumps hot money into the banking system. Excess reserves beget margin loans. Margin loans, by definition, fuel speculation. Then, poof. "In my opinion," writes one contemplative reader following our investment thesis with some skepticism, "trying to use gold, tulips or any substance to control bankers and politicians is a cop-out. It's like using burqas in Islam to prevent men from getting bothered by attractive women... [these speculative rallies] are part of our nature." Indeed, the easy money works great... until it doesn't work anymore. "I am sure politicians," the reader goes on, "if really interested in devaluing the dollar with gold as a backup could figure a way to manipulate the price of gold for their own use. Isn't this what politicians do best?" Perhaps they ought to try it. Just a little... Alas, devaluing the dollar, sans gold, is part and parcel of the Fed's currency war against other deflating fiat currencies. James Rickards, author of Currency Wars and today's guest essay for The Daily Reckoning, knows all too well. In today's episode, Mr. Rickards shows how you're stuck in the middle of the Fed's tug-of-war match with the forces of deflation... [Ed. Note. Mr. Rickards will be joining us as a speaker at this year's Investment Symposium at the Fairmont Hotel in Vancouver, British Columbia, July 23-26, 2013. There are fewer than 200 seats left. If you'd like to attend, hurry up and reserve yours, here.] |

||

Social networking sites,progressive & constitutional politics;international politics,music & culture, environmental issues & incidents,economy,non-profit organizations and causes. keywords" content="social networking, Facebook, MySpace,economy,central banking AdlandPro,travel,travel photography,Ukraine,Europe,energy alternatives,oil & gas,save environment http://adlandpro-facebook-friendswin-social.blogspot.com/google157bc6f4ded2ee5e.html

Read This Blog in 9 Different Languages

Thursday, June 20, 2013

Addison Wiggin contemplating the market's reaction to the Fed (after a long nap)...

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment